Where to Get Credit Card Numbers?

We all want free credit card numbers so we can buy stuff and not have to pay for them. But that’s what this story is about. If you just want free numbers go here. Finally, you will a CVV number to go along with your credit card number.

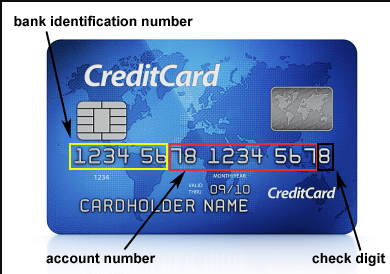

We’ve all used credit cards at some point in our lives, but have you ever stopped to wonder what the string of numbers on the front actually mean? It’s easy to overlook this important detail, but understanding your what is the card number on a credit card is crucial for things like online purchases and fraud prevention. In this post, we’ll dive into the meaning behind those digits – and who knows, you might just impress your friends with your newfound knowledge. So grab a cup of coffee (or tea if that’s more your style), settle in, and let’s get started!

What is a credit card number?

A credit card number is a sequence of numbers that appears on the front of a credit card. The first two digits are the account number, which is also the unique identifier for that particular credit card account. The next three or four digits are the sequential number assigned to that particular card when it was issued. If you want some free numbers check out Graham King’s Website.

What does the number on a credit card mean?

The number on a card is not the actual bank account number. Instead it is a number assigned to the bank. This bank assigned number is typically six digits long and begins with the first two numbers of the bank’s issuing institution. For example, if your credit card is issued by Chase, the number would be 21.

What are the different types of credit cards?

Visa cards: Visa is the most popular type of card in the world, accounting for more than two-thirds of all transactions. With a Visa card, you can use your card to purchase items in stores and online. You’ll also be able to receive cash advances and make payments on your credit card bills. Some potential drawbacks include high-interest rates and fees associated with using a Visa card.

Mastercard: Mastercard is another popular type of card, used mainly for online transactions. Unlike Visa cards, which are linked directly to your bank account, Mastercard transactions are processed through a third party such as PayPal or Amazon.com. This could mean higher fees and fewer customer protections should something go wrong with your purchase. Another potential downside is that Mastercard doesn’t offer as many perks as Visa cards do, such as access to cash advances or free hotel stays when you use your card at participating hotels.

American Express: American Express is one of the oldest and most respected credit cards in the world. It’s especially popular among high-net-worth individuals (HNWIs) because it offers some unique benefits not found on other types of cards, such as membership status with exclusive clubs like The Ritz-Carlton International Club and bonus points for spending at select retailers like Saks Fifth Avenue and Neiman Marcus. One drawback

How to use a debit card

When you use a what is the card number on a credit card is actually a digital identification number that looks something like this: 4 digits, followed by a hyphen, and then 3 more digits. The first two digits represent the bank where the card was issued, while the last digit represents the branch of that bank. For example, if your debit card has a card number of 1234-5678, it means that the debit card was issued by Bank of America at their main branch in Los Angeles, and the 5 represents the fifth digit in the range from 01 to 09.

How to protect your credit score

Credit scoring models can use different factors to calculate a person’s credit score, but the most important piece of information is the card number. This number uniquely identifies a particular credit card account.

If you lose your card, or if it’s stolen, the thief can not only use the card numbers to make new purchases but also to attempt to open new accounts in your name. In fact, according to The New York Times, “stolen credit cards are an increasing problem for consumers and businesses.” If you’re concerned about your credit score and want to protect yourself, make sure to shred any old cards and keep a copy of your current card number in a safe place.

Conclusion

The card number on a card may seem like a simple code, but it holds a lot of information. In this article, we will explore what the different digits mean and how they are used. Hopefully, this knowledge can help you better understand your credit card and protect yourself when using it.